Investor relations

Welcome to the investor relations section.

This area is organized to efficiently and transparently meet the information needs of the entire financial community.

Financial highlights

Data Highlights

Consolidated Group as of 12/31/2024

Net Invested Capital

(+129% vs 2023)

Consolidated Net Worth

(+25% vs 2023)

Net financial debt

Consolidated Net Profit for the year

Pro Forma Consolidated Net Asset Value per Share

(*) Available cash

IPO

In order to access the Admission Document (the Admission Document), you must read and accept the disclosure below, which the reader must consider carefully before reading, accessing, using, or otherwise dealing in any way with the information provided below. By accessing the section containing the Admission Document of this website, you agree to be subject to the terms and conditions set forth below, which may be subsequently amended or updated and, therefore, should be read in full each time you access the aforementioned section of this website.

The Admission Document has been prepared, pursuant to the regulations applicable to issuers of the multilateral trading system, organized and managed by Borsa Italiana S.p.A., “Euronext Growth Milan” (the Euronext Growth Milan Issuers’ Regulations), for the purpose of the admission of the ordinary shares (the Shares) of REDFISH LONGTERM CAPITAL S.p.a. (the Company) to that multilateral trading system.

The Admission Document and the transaction described therein, as well as any other information contained therein, do not constitute an “offer to the public” of financial instruments – as defined in Legislative Decree No. 58 of February 24, 1998, as subsequently amended and supplemented (the TUF) -, so that it is not necessary to prepare a prospectus in accordance with the formats required by EU Regulation No. 1129/2017 and Delegated European Regulation No. 980/2019, except as required by the Euronext Growth Milan Issuers’ Regulations.

Therefore, the Admission Document does not constitute a prospectus within the meaning of the aforementioned regulations, and its publication does not need to be authorized by CONSOB pursuant to EU Regulation No. 1129/2017 or any other rules or regulations governing the preparation and publication of prospectuses pursuant to Articles 94 and 113 of the TUF, including the Issuers’ Regulations adopted by CONSOB with Resolution No. 11971 of May 14, 1999, as subsequently amended and supplemented.

The information contained in the section of this website you are about to access is disseminated in accordance with the provisions of Articles 17 and 26 of the Euronext Growth Milan Issuers’ Regulations.

The information contained in the aforementioned section of this website and in the Admission Document may not be copied or forwarded and is accessible only to persons who: (a) are residents of Italy and who are not domiciled or otherwise currently located in the United States of America, Australia, Japan, Canada as well as in any other country in which the dissemination of the Admission Document and/or the aforementioned information requires the approval of the competent local authorities or is in violation of local rules or regulations (the Other Countries), and (b) are not “U. S. Person” as defined in Regulation S of the United States Securities Act of 1933, as amended, nor are they persons acting on their behalf or for their benefit without the existence of a special registration or specific exemption to registration provided under the United States Securities Act of 1933, as amended, and applicable law. A “U.S. Person” in the above sense is precluded from accessing the aforesaid section of this website and from downloading, storing and/or temporarily or permanently saving the Admission Document and any other information contained in such section of this website.

For no reason and under no circumstances is it permitted to circulate, directly or through third parties, the Admission Document and any other information contained in the relevant section of this website outside Italy, in particular in the United States, Australia, Japan, Canada or the Other Countries, nor is it permitted to distribute the Admission Document to a “U.S. Person” in the sense indicated above. Failure to do so may result in a violation of the United States Securities Act of 1933, as amended, or applicable law in other jurisdictions.

The information contained in this website (or any other site with which this website has hyperlinks) does not constitute an offer, invitation to offer, or promotional activity in connection with the actions with respect to any citizen or person residing in Canada, Australia, Japan, or the United States of America or any of the Other Countries.

The Shares are not and will not be the subject of registration under the United States Securities Act of 1933, as amended, or with any regulatory authority of any state or other jurisdiction of the United States of America and may not be offered or sold in the United States of America or to, or for the account or benefit of, a “U.S. Person,” within the meaning stated above, absent such registration or express exemption from such compliance or in other countries where the offering of shares is restricted under applicable law.

Regulation S of the United States Securities Act of 1933, as amended, defines as a “U.S. Person”: (1) any natural person resident in the United States; (2) “partnerships” and “corporations” incorporated and organized under the laws in force in the United States; (3) any property whose directors or managers are a “U. S. Person”; (4) trusts whose trustee is a “U. S. Person”; (5) any agency, branch, or subsidiary of a person located in the United States; (6) accounts of a non-discretionary nature (“non-discretionary accounts”); (7) other similar accounts (other than property or trusts), managed or administered on a fiduciary basis for the account or benefit of a “U. S. Person”; (8) “partnerships” and “corporations” if (i) formed and organized under the laws of any foreign jurisdiction; and (ii)formed by a “U.S. Person” for the principal purpose of investing in securities not registered under the United States Securities Act of 1933, as amended, unless formed or organized and owned by accredited investors (as defined in Rule 501(a) of the United States Securities Act of 1933, as amended) who are not individuals, estates or trusts.

In order to access the Admission Document and the relevant section of this website, the Admission Document and any other information contained in the following pages, I declare under my full responsibility that I am a resident of Italy and that I am not currently domiciled or located in the United States of America, Australia, Japan, Canada or the Other Countries and that I am not a “U.S. Person” as defined in Regulation S of the United States Securities Act of 1933, as amended.

To confirm that you have read and agree to the above terms and conditions

Euronext Growth Advisor, Global Coordinator

Issuer’s legal counsel

Euronext Growth Legal Advisor and Global Coordinator

Auditing Company

Equity Research Provider

Investor & Media Relations

Anna D’Agostino

Labor Consultant

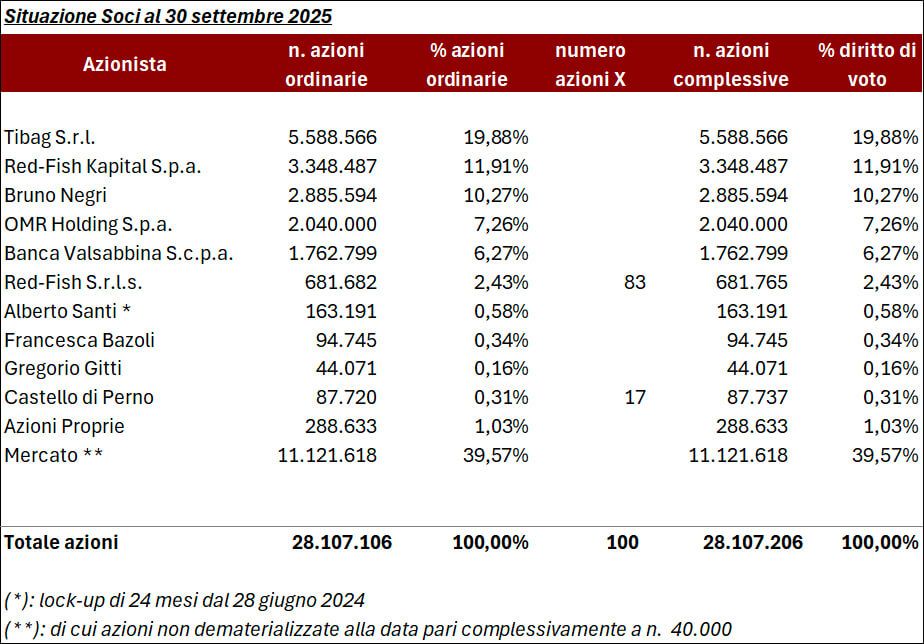

Shareholders and social capital

Information Obligations of Significant Shareholders

Pursuant to the Euronext Growth Milan Italia Issuers’ Regulations approved and published by Borsa Italiana as amended and supplemented (“Euronext Growth Milan Issuers’ Regulations”), anyone who comes to hold at least 5% of a class of financial instruments of RedFish LongTerm Capital admitted to trading on Euronext Growth Milan is a “Significant Shareholder.” Reaching or exceeding the thresholds of 5%, 10%, 15%, 20%, 25%, 30%, 50%, 66.6%, and 90% of the share capital, as well as falling below the aforementioned thresholds, constitutes, pursuant to the Euronext Growth Milan Issuers’ Regulations, a “Substantial Change” that must be reported by Significant Shareholders to RedFish LongTerm Capital within 4 trading days, starting from the day on which the transaction resulting in the Substantial Change was carried out.

Such notice must indicate:

- the identity of the Significant Shareholders involved;

- the date on which RedFish LongTerm Capital was informed;

- the date on which the Substantial Change of Shareholdings occurred;

- the price, amount and category of the RedFish LongTerm Capital financial instruments involved;

- the nature of the transaction;

- the nature and extent of the Significant Shareholder’s interest in the transaction.

For this purpose, each Significant Shareholder may use the disclosure templates set forth in the “Discipline on Transparency” (as defined in the Euronext Growth Milan Issuers’ Regulations) with particular regard to information and communications due from Significant Shareholders. Such disclosure shall be made by registered letter with return receipt to be sent to the Company’s Board of Directors, to the Company’s Investor Relations address and to the Company’s PEC address.

Financial statements and periodic reports

Stock performance

-

Ticker Code: RFLTC

-

ISIN Code Stocks: IT0005549354

-

Warrant ISIN Code: IT0005549347

-

Minimum lot size: 1.000

Financial press releases

Calendario finanziario

27 July 2023 | Consiglio di Amministrazione per l’approvazione dei Ricavi consolidati, dei Ricavi consolidati Proforma e del Back-log¹ ordinativi della controllata Movinter al 30 giugno 2023, non sottoposti a revisione contabile |

29 September 2023 | Consiglio di Amministrazione per l’approvazione della Relazione Finanziaria Semestrale Consolidata al 30 giugno 2023 sottoposta volontariamente a revisione contabile limitata. |

(1) Back-log inteso come ordini firmati da clienti alla data di riferimento ed ancora da evadere (2) Dati gestionali non sottoposti a revisione contabile (3) Informazioni Finanziarie Consolidate Pro-forma del Gruppo al 31 dicembre 2023 sottoposte a procedure di assurance da parte della Società di Revisione, che esprimerà un giudizio sulla correttezza dei criteri di predisposizione applicati e sulla coerenza degli stessi con i principi contabili adottati dal Gruppo. |

18 January 2024 | (prima convocazione) Assemblea Ordinaria per approvazione dell’autorizzazione all’acquisto e alla disposizione di azioni proprie |

22 January 2024 | (seconda convocazione) Assemblea Ordinaria per approvazione dell’autorizzazione all’acquisto e alla disposizione di azioni proprie |

30 January 2024 | Consiglio di Amministrazione per l’approvazione dei Ricavi consolidati, dei Ricavi consolidati Proforma e del Back-log¹ ordinativi della controllata Movinter al 31 dicembre 2023², non sottoposti a revisione contabile |

28 March 2024 | Consiglio di Amministrazione per l’approvazione del progetto di Bilancio dell’esercizio chiuso al 31 dicembre 2023, del bilancio consolidato di Gruppo e delle Informazioni Finanziarie Consolidate Proforma del Gruppo al 31 dicembre 2023³ . |

24 April 2024 | Consiglio di Amministrazione per l’approvazione dei Ricavi consolidati, dei Ricavi consolidati Proforma e del Back-log¹ ordinativi della controllata Movinter al 31 marzo 2024², non sottoposti a revisione contabile. |

29 April 2024 | (prima convocazione) Assemblea Ordinaria per approvazione del Bilancio di esercizio al 31 dicembre 2023. |

30 April 2024 | (seconda convocazione) Assemblea Ordinaria per approvazione del Bilancio di esercizio al 31 dicembre 2023. |

26 July 2024 | Consiglio di Amministrazione per l’approvazione dei Ricavi consolidati, dei Ricavi consolidati Proforma e del Back-log¹ ordinativi della controllata Movinter al 30 giugno 2024², non sottoposti a revisione contabile. |

30 September 2024 | Consiglio di Amministrazione per l’approvazione della Relazione Finanziaria Semestrale Consolidata al 30 giugno 2024 sottoposta volontariamente a revisione contabile limitata. |

29 October 2024 | Consiglio di Amministrazione per l’approvazione dei Ricavi consolidati, dei Ricavi consolidati Proforma e del Back-log¹ ordinativi della controllata Movinter al 30 settembre 2024², non sottoposti a revisione contabile. |

(1) Back-log inteso come ordini firmati da clienti alla data di riferimento ed ancora da evadere (2) Dati gestionali non sottoposti a revisione contabile (3) Informazioni Finanziarie Consolidate Pro-forma del Gruppo al 31 dicembre 2023 sottoposte a procedure di assurance da parte della Società di Revisione, che esprimerà un giudizio sulla correttezza dei criteri di predisposizione applicati e sulla coerenza degli stessi con i principi contabili adottati dal Gruppo. |

30 January 2025 | Consiglio di Amministrazione per l’approvazione dei Ricavi consolidati, dei Ricavi consolidati Proforma e del Back-log¹ ordinativi della controllata Movinter S.p.A. e relative controllate, al 31 dicembre 2024², non sottoposti a revisione contabile |

25 July 2025 | Consiglio di Amministrazione per l’approvazione dei Ricavi consolidati, dei Ricavi consolidati Proforma e del Back-log¹ ordinativi della controllata Movinter S.p.A. e relative controllate, al 30 giugno 2025², non sottoposti a revisione contabile. |

30 September 2025 | Consiglio di Amministrazione per l’approvazione della Relazione Finanziaria Semestrale Consolidata al 30 giugno 2025 sottoposta volontariamente a revisione contabile limitata. |

27 October 2025 | Consiglio di Amministrazione per l’approvazione dei Ricavi consolidati, dei Ricavi consolidati Proforma e del Back-log¹ ordinativi della controllata Movinter S.p.A. e relative controllate, al 30 settembre 2025², non sottoposti a revisione contabile. |

31 March 2025 | Consiglio di Amministrazione per l’approvazione del progetto di Bilancio dell’esercizio chiuso al 31 dicembre 2024, del bilancio consolidato di Gruppo e delle Informazioni Finanziarie Consolidate Proforma del Gruppo al 31 dicembre 2024³. |

29 April 2025 | Consiglio di Amministrazione per l’approvazione dei Ricavi consolidati, dei Ricavi consolidati Proforma e del Back-log¹ ordinativi della controllata Movinter S.p.A. e relative controllate, al 31 marzo 2025², non sottoposti a revisione contabile. |

29 April 2025 | (prima convocazione) Assemblea Ordinaria per approvazione del Bilancio di esercizio al 31 dicembre 2024. |

30 April 2025 | (seconda convocazione) Assemblea Ordinaria per approvazione del Bilancio di esercizio al 31 dicembre 2024. |

26 January 2026 | Consiglio di Amministrazione per l’approvazione dei Ricavi consolidati e del Back-log¹ ordinativi della controllata Movinter S.p.A. e relative controllate, al 31 dicembre 2025², non sottoposti a revisione contabile. |

(1) Back-log inteso come ordini firmati da clienti alla data di riferimento ed ancora da evadere (2) Dati gestionali non sottoposti a revisione contabile (3) Informazioni Finanziarie Consolidate Pro-forma del Gruppo al 31 dicembre 2024 sottoposte a procedure di assurance da parte della Società di Revisione, che esprimerà un giudizio sulla correttezza dei criteri di predisposizione applicati e sulla coerenza degli stessi con i principi contabili adottati dal Gruppo |

26 January 2026 | Consiglio di Amministrazione per l’approvazione dei Ricavi consolidati e del Back-log¹ ordinativi della controllata Movinter S.p.A. e relative controllate, al 31 dicembre 2025², non sottoposti a revisione contabile. |

30 March 2026 | Consiglio di Amministrazione per l’approvazione del progetto di Bilancio dell’esercizio chiuso al 31 dicembre 2025, del bilancio consolidato di Gruppo al 31 dicembre 2025. |

23 April 2026 | Consiglio di Amministrazione per l’approvazione dei Ricavi consolidati e del Back-log¹ ordinativi della controllata Movinter S.p.A. e relative controllate, al 31 marzo 2026², non sottoposti a revisione contabile. |

29 April 2026 | (prima convocazione) Assemblea Ordinaria per approvazione del Bilancio di esercizio al 31 dicembre 2025 e rinnovo dell’organo amministrativo, del collegio sindacale e della società di revisione |

30 April 2026 | (seconda convocazione) Assemblea Ordinaria per approvazione del Bilancio di esercizio al 31 dicembre 2025 e rinnovo dell’organo amministrativo, del collegio sindacale e della società di revisione |

23 July 2026 | Consiglio di Amministrazione per l’approvazione dei Ricavi consolidati e del Back-log¹ ordinativi della controllata Movinter S.p.A. e relative controllate, al 30 giugno 2026², non sottoposti a revisione contabile. |

30 September 2026 | Consiglio di Amministrazione per l’approvazione della Relazione Finanziaria Semestrale Consolidata al 30 giugno 2026 sottoposta volontariamente a revisione contabile limitata. |

23 October 2026 | Consiglio di Amministrazione per l’approvazione dei Ricavi consolidati e del Back-log¹ ordinativi della controllata Movinter S.p.A. e relative controllate, al 30 settembre 2026², non sottoposti a revisione contabile. |

26 January 2027 | Consiglio di Amministrazione per l’approvazione dei Ricavi consolidati e del Back-log¹ ordinativi della controllata Movinter S.p.A. e relative controllate, al 31 dicembre 2026², non sottoposti a revisione contabile. |

(1) Back-log inteso come ordini firmati da clienti alla data di riferimento ed ancora da evadere (2) Dati gestionali non sottoposti a revisione contabile |

Analysts and recommendations

IR Contacts

Si segnala che per la diffusione delle informazioni regolamentate la società RedFish LongTerm Capital S.p.a. si avvale del circuito EMarket SDIR – Storage TeleBorsa.

investor.relations@redfish.capital

CDR Communication

Vincenza Colucci

vincenza.colucci@cdr-communication.it

CDR Communication

Marika Martinciglio

marika.martinciglio@cdr-communication.it